Our Compliance Documents

We are required by law to display our compliance documents for the benefit of all customers

Why should you care?

It is important for us to display our compliance documents to show that we are accredited to be offering the services that we do. As a client, you need to be sure that you use services from a licensed agent who is backed up by the appropriate authorities. By displaying our certificates you can rest assured, using our services, that we are fully registered with all appropriate authorities.

If you have any questions about our accreditation, our fees or our complaints procedure then please don't hesitate to get in touch.

Client Money Protection (CMP)

The Propertymark Conduct and Membership Rules can be found here: www.propertymark.co.uk/professional-standards/rules.html#obligations.

The Property Ombudsman (TPO)

Our membership number for TPOS is L850. You can search our membership in the event of wanting to make a formal complaint about our services here.

Deposit Protection Service (DPS)

We are members of the Deposit Protection Service (DPS), our membership ID is 1363994. You can check to see if your deposit is properly protected by following this link.

Tenancy Deposit Scheme (TDS)

We are members of the Tenancy Deposit Scheme (TDS), our membership number is EW100270. You can check to see if your deposit is properly protected by following this link.

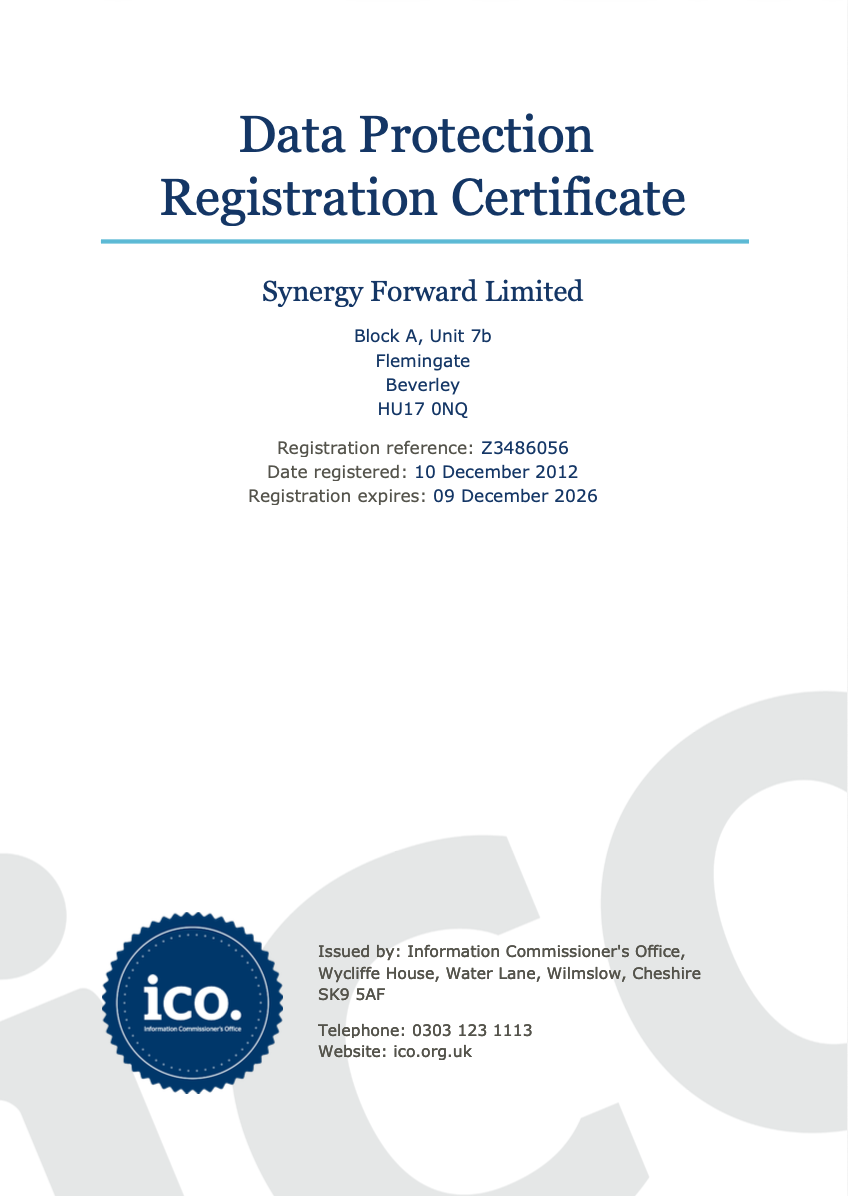

Information Commissioner's Office Registration (ICO)

Our registration reference number for the ICO is Z3486056. You can search our membership here.

Anti Money Laundering (AML) Policy

Synergy Forward Limited t/a Ultralets is committed to complying with all applicable Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) legislation, including the Money Laundering Regulations 2017 and the Terrorism Act 2000. This policy outlines our procedures for preventing and detecting money laundering activities.

- Customers making purchases in any currency (including cryptocurrencies)

- Users registering for accounts

- Users engaging in any financial transactions

- Money laundering: The process of making illegally obtained funds appear legitimate.

- Terrorist financing: Providing or collecting funds to support terrorist activities.

- Know Your Customer (KYC): The process of verifying the identity and background of customers.

- Customer Due Diligence (CDD): The process of gathering and analysing information about customers to assess their money laundering and terrorist financing risks.

- Suspicious Activity Report (SAR): A report filed with authorities about suspected money laundering or terrorist financing activity.

- Identity verification: Verifying your name, address, date of birth, and other relevant information using government-issued documents or other reliable methods.

- Enhanced due diligence: Conducting additional CDD for high-risk customers or transactions based on certain factors, such as:

- Transactions exceeding £15,000 in cash equivalent.

- Transactions involving politically exposed persons (PEPs) or high-risk countries.

- Transactions with unusual patterns or characteristics.

- Transactions that are inconsistent with the customer's known profile.

- Transactions exceeding certain thresholds.

- Transactions involving high-risk countries or customers.

- Transactions with unusual patterns or characteristics.

- Transactions that are inconsistent with the customer's known profile.

VII. Data Protection

VIII. Training and Awareness

The following prices apply to Residential and Commercial property management and letting services. We are required by law to display all of our prices inclusive of VAT.

Comprehensive full management & lettings service

Letting Fee: £360.00 INC VAT (Payable when let and re-let)

Monthly Management Fee: 12% INC VAT (10% +VAT) on a portfolio between 1 and 4 properties. 10.8% INC VAT (9% +VAT) on a portfolio between 5 and 9 properties. 9.6% INC VAT (8% +VAT) on a portfolio of 10 or more properties. (Subject to a minimum of £44.40 INC VAT)

Let only service

Our Let Only service is chargable at the rate of one month’s rent (with a minimum fee of £600.00 inc VAT). A non-refundable fee of £300.00 inc VAT is due at the point of marketing. This covers our administration and marketing costs. The remainder of the fee is payable at the start of the tenancy.

Other charges to landlords

| Annual Gas Safety Certificate (GSC CP12) | From £72.00 (further cost per additional appliance) |

| Annual Gas Safety Certificate (GSC CP12) + Boiler Service | From £96.00 (further cost per additional appliance) |

| Oil-fuelled Boiler Service | £108.00 per hour |

| Legionnaires Risk Assessment | £66.00 |

| Energy Performance Certificate (EPC) | From £96.00 |

| Electrical Safety Test (EICR) | From £100.00 (subject to remedial work) |

| Battery-powered smoke alarms supplied and installed | £60.00 per unit |

| Carbon monoxide alarms supplied and installed | £50.00 per unit |

| Our maintenance engineers (rate doubled for evenings, weekends and bank holidays) | £36.00 per hour plus materials |

| Organisation of property maintenance through a third party contractor | 10% of the invoice (minimum of £10.00 and a maximum of £100.00 per job)* |

| Any variations to Ultralets’ standard tenancy agreement | £48.00 |

| Mortgage advice fee | £495.00** on production of mortgage offer |

| Withdrawal of listing following marketing or commencement of the referencing process | £100.00 inc VAT |

All prices shown are inclusive of VAT and subject to change due to variations in material and labour costs. Changes to pricing are to be issued by email with a minimum of 3 months' notice. In the unlikely event of Ultralets not being able to contact a landlord, any urgent repair shall be effected on behalf of the landlord and be invoiced, including any reasonable costs incurred by Ultralets as per our payment terms. *VAT is applied on the total value of works. **Mortgage advice fee is not subject to VAT.

Charges to tenants

- Key deposits: £20.00 per key (To be collected from the office with 2 hours notice)

- Attending to give access to property (24Hrs): £40.00 INC VAT (Payable on attendance)

- Amending or renewing a tenancy agreement: £48.00 INC VAT

- Application holding deposit: Equivalent to 1-week rent held for up to 14 days & deducted from the deposit paid on move-in.

- 5-week deposit payable in addition to the first month's rent on or before the day you move in.

Referral fees

Occasionally, Ultralets may refer certain business to our trusted third-party providers. It is important to note that when a referral occurs, it is still completely your choice as to whether or not you proceed with those providers. Please see a list of our referral fees below:

Sales referral fees:

During the initial fact-finding of the sales process, we may determine that your property/portfolio is better suited to be sold through a channel outside our investment network. In these instances, we may refer you to a third-party, local, agent. Similarly, when instructing a solicitor we have trusted third-party businesses that we may refer you to.

- Riverside Estate Agents - 20% of their total fee

- Our House Estate Agents - 20% of their total fee

- James Legal Solicitors - £100 + VAT per referral

- Gunnercooke Solicitors - £100 + VAT per referral

- Pattinsons Auctions - £2,500 + VAT per property we pass to them

Insurance referral fees

During your journey using our insurance services, we may determine that you are better suited to a policy that is available with another provider. In these instances, we may refer you to one of the below, trusted, third-party providers:

- The Source - 27.5% of their deal value

- Higos - 15% of their deal value

- HL Wills - £30 per Will

If you're switching to Ultralets from another agent, you may request for your exit fees to be paid for by Ultralets with the following conditions:

- Exit fees need to be requested prior to signing Ultralets Terms of Business

- At the point of requesting the exit fees, disclosure of the full amount needs to be provided to Ultralets in writing

- Should Ultralets deem the exit fee penalties to be unviable, then Ultralets reserve the right to negotiate either with the Agent or negotiate with the potential client to find a workable solution

- In the event that a workable solution is not achievable, then Ultralets reserves the right to withdraw this offer

- Once an agreed solution has been agreed, both the potential client and Ultralets shall agree the terms in writing, prior to the signing of Ultralets Terms of Engagement

- The terms of this offer are made entirely at the discretion of the Lettings Manager, who has the right not to provide, or the option to withdraw the option at any point prior to the signing of Ultralets Terms of Engagement.

- The exit fees will only be paid directly to the Agent who previously managed the property. However, if you require them to be paid to you directly, proof will be required to show that you have already paid them to your previous Letting Agent. Any attached files will need to be in pdf format

Our complaints procedures

If you have used our lettings/management services and wish to make a complaint, you can view the procedure here.

If you have purchased insurance through Ultralets and wish to make a complaint, you can view the procedure here.